[Answered] NR-500NP Week 1 Discussion The Value of a Master’s Prepared Nurse

Course NR-500-NP: Foundational Concepts and Advanced Practice Roles Welcome to NR500NP! We are so happy you decided to embark on your master’s degree journey with us! Please use this thread […]

[Solutions] FIN 564 – Management Of Financial Institutions -Assignments

FIN 564 Week 1 Homework Assignment FIN 564 Week 2 Homework Assignment FIN 564 Week 3 Homework Assignment FIN 564 Week 4 Homework Assignment FIN 564 Week 5 Homework Assignment […]

[Solution] FIN 564 Course Project: Fifth Third Bank Analysis

Instructions This paper is a comprehensive analysis of the financial standing of Fifth Third Bank. In the first part we will review Fifth Third Bank’s profile, mission statement and future […]

[Solution] FIN 564 Week 7 Homework Assignment: Bankone

Chapter 9 Problem 5 – Bankone issued $200 million worth of one-year CD liabilities in Brazilian reals at a rate of 6.50 percent. The exchange rate of U.S. dollars for Brazillian reals […]

[Solution] FIN 564 Week 6 Homework Assignment: Insurance

Chapter 15 Problem 6 – An insurance company’s projected loss ratio is 77.5 percent, and its loss adjustment expense ratio is 12.9 percent. It estimates that commission payments and dividends to […]

[Solution] FIN 564 Week 5 Homework Assignment -All Chapters

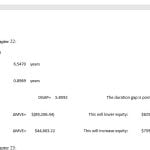

Chapter 22 Problem 10 – Use the following balance sheet information to answer this question…… What^is the average duration of all the assets? What.is the average duration of all the liabilities? What-is […]

[Solution] FIN 564 Week 4 Homework Assignment -WatchoverU Savings

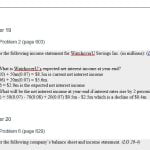

Chapter 19 Problem 2 – Consider the following income statement for WatchoverU Savings Inc. (in millions): What is WatchoverU’s expected net interest income at year-end? What will be the net interest […]

[Solution] FIN 564 Week 3 Homework Assignment – Financial statements

Chapter 12 Problem 6: The financial statements for THE Bank are shown below:……… Calculate.THE Bank’s earning assets. Calculate-THE Bank’s ROA Calculate THE Bank’s total operating income Calculate THE Bank’s spread […]

[Solution] FIN 564 Week 2 Homework Assignment: All Problems

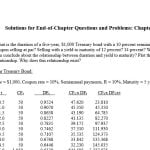

Problems 6 – What is the duration of a five-year, $1,000 Treasury bond with a 10 percent semiannual coupon selling at par? Selling with a yield to maturity of 12 percent? 14 […]