Course

ACCT 212 Financial Accounting

Week 3 Homework Accounting Cycle

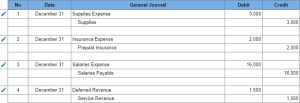

1. Question: Golden Eagle Company prepares monthly financial statements for its bank. The November 30 adjusted trial balance includes the following account information: …….. The following information is known for the month of December:

1. Purchases of supplies during December total $4,500. Supplies on hand at the end of December equal $3,500.

2. No insurance payments are made in December. Insurance cost is

$2,000 per month.

3. November salaries payable of $11,000 were paid to employees in December. Additional salaries for December owed at the end of the year are $16,000.

4. On November 1, a tenant paid Golden Eagle $4,500 in advance rent for the period November through January, and … Revenue was … for the entire amount.

Required:

Show the adjusting entries that were made for supplies, … insurance, salaries payable, and … revenue on December 31. (If no entry is required for a particular transaction/event, select “No Journal Entry …” in the first account field.)

2. Question: Consider the following transactions for Huskies Insurance Company:

1. Equipment costing $39,600 is … at the beginning of the year for cash. Depreciation on the equipment is $6,600 per year.

2. On June 30, the company lends its chief financial officer

$46,000; principal and interest at 6% are due in one year.

3. On October 1, the company receives $14,400 from a customer for a one-year property insurance policy. Deferred Revenue is …

Required:

For each item, record the necessary adjusting entry for Huskies Insurance at its year-end of December 31. No adjusting entries were made during the year. (If no entry is … for a particular transaction/event, select “No Journal Entry …” in the first account field. Do not round intermediate calculations.)

3. Question: Consider the following situations for Shocker:

1. On November 28, 2021, Shocker receives a $3,300 payment from a customer for services to … evenly over the next three months. … Revenue is credited.

2. On December 1, 2021, the company pays a local radio station

$2,460 for 30 radio ads that were to … , 10 per month, throughout December, January, and February. Prepaid Advertising is …

3. Employee salaries for the month of December totaling $7,200 will … paid on January 7, 2022.

4. On August 31, 2021, Shocker borrows $62,000 from a local bank. A note is … with principal and 6% interest to be paid on August 31, 2022.

Required:

Record the necessary adjusting entries for Shocker at December 31, 2021. No adjusting entries were made during the year. (If no entry is … for a particular transaction/event, select “No Journal Entry …” in the first account field. Do not round intermediate calculations.)

4. Question: Boilermaker Unlimited specializes in building new homes and remodeling existing homes. Remodeling projects include adding game rooms, changing kitchen cabinets and countertops, and updating bathrooms. Below is the year- end … trial balance of Boilermaker Unlimited.

Required:

1. Prepare an income statement for the year … December 31, 2021.

2. Prepare the statement of stockholders’ equity for the year ended December 31, 2021, note that during the year the company … additional common stock for $29,000. This amount is … in the amount for Common Stock in the adjusted trial balance.

3. Prepare the … balance sheet for the year ended December 31,

SOLUTION

- Golden Eagle Company prepares monthly financial statements for its bank. The November 30 adjusted trial balance includes the following account information:

……please click the icon below to purchase the solution at $10